If you've been informed that you have to pay a service charge and have never paid one before, you may have no point of comparison. This can leave you wondering whether your service charge is reasonable or not. So, what is a reasonable service charge?

In this insight, we will break down the factors that can help you determine if your service charge is reasonable, based on your amenities as well as England's average service charge data, researched by Sunny Avenue.

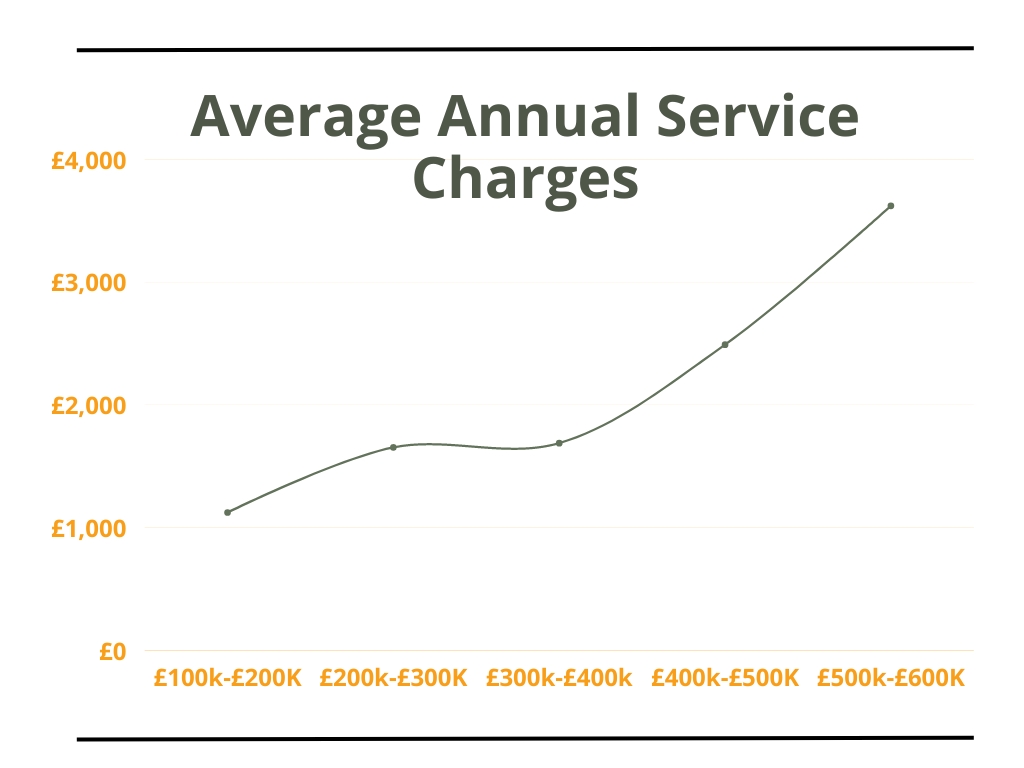

The average annual service charge is £2216, based on English properties of up to £600k and £1,654 up to £300k. To determine if your service charge is reasonable, you need to consider the size of your property alongside what amenities you are paying for. For example, if you have leisure facilities, expect to pay more for maintenance.

A service charge is a fee paid by leaseholders to their landlord. It covers maintenance, upkeep of communal areas, and necessary repairs. It includes things like cleaning common areas, building insurance, and lift maintenance. The service charge should be reasonable and reflect the building's needs. It's calculated by the landlord based on previous expenses and future costs.

To assess what we believe is a reasonable service charge, Sunny Avenue has researched 60 properties with service charges across England and different value brackets, ranging from 200K to 600k. We used a Median to find the average service charge for each bracket. It is worth noting, these properties are random and as prices increased, there were a greater number of properties from the South, where property prices are more expensive. A more expensive property will usually come with a higher service charge,

These are our findings:

| Property Value Range | Average Annual Service Charge (£) |

|---|---|

| £100k - £200k | £1,124.42 |

| £200k - £300k | £1,654.60 |

| £300k - £400k | £1,689.30 |

| £400k - £500k | £2,491.70 |

| £500k - £600k | £3,621.90 |

Looking at the data, we can see that as the property value goes up, the average service charge also tends to go up. For properties worth £100k-£200k, the average charge is £1,124.42, while for properties worth £500k-£600k, the average charge is £3,621.90. This means that higher-priced properties usually have higher service charges because they may have more maintenance needs or extra amenities. Remember, these are averages and individual properties may have different charges based on their specific features.

Consider the data as an average property type, if your property sits within the above ranges with higher-than-average facilities, you may expect to pay a higher service charge.

To determine if your service charge is reasonable there are some factors to consider. These factors normally work in a simple way. The more facilities, space, gardens, communal areas, and the older the property, the more you can expect to pay. Consider your property against these facilities and think about the costs associated with these:

Think about what you get in return for the service charge, like maintenance, security, cleaning, and shared facilities. If you receive good amenities and services, it can justify a higher charge.

Consider the size of your property compared to others in the same building. Bigger properties usually have higher charges because they require more maintenance and care.

Take into account where your property is located. Charges can vary based on the local property market, cost of living, and nearby amenities. Living in a more desirable or convenient area might mean higher charges.

The age and condition of the building can affect charges. Older buildings often need more repairs and maintenance, which can impact the service charge.

Look into what others in similar properties have paid in the past. This can give you an idea of what's considered normal for your area and help you judge if your charge is reasonable.

If you think your service charge is not a reasonable amount, here's what you can do:

Property type can have a large affect on the amount of service charge you need to pay. For example, if you own a leasehold on a maisonette, you will need to split the costs with only one other leaseholder. That can result in higher service charge costs. Where as, if you own a leasehold in a large block of flats, you are able to split the maintenance costs with the other leaseholders. If you do not have a lot of facilities, you may not have to pay so much.

The cost of maintaining communal areas, such as gardens and shared spaces, will be split between the two leaseholders in a maisonette. Since there are fewer leaseholders sharing the cost, the individual share can be higher compared to properties with more leaseholders. This is because the maintenance costs are distributed among a smaller group.

If the maisonette has additional shared facilities like a communal gym or parking area, the maintenance and upkeep costs for those facilities will also be divided between the two leaseholders. This can contribute to higher service charges compared to properties without such facilities.

The overall size and scale of the property can influence service charges. Maisonettes often have their own individual external areas, such as gardens or balconies, which may require separate maintenance and incur additional costs compared to apartments or flats.

The efficiency and professionalism of the property management company can also impact service charges. Well-managed properties may have lower service charges due to effective cost management and economies of scale.

If you live in a big block of flats, you'll likely have more neighbours and shared areas like lobbies, hallways, and gardens. Maintaining these spaces and amenities costs money, so the service charges tend to be higher to cover those expenses.

In large blocks, you might share things like lifts, parking areas, or leisure facilities. The cost of cleaning, repairing, and maintaining these shared spaces adds to the service charges, especially since more flats are sharing the costs.

Managing and maintaining large blocks requires more staff and resources. Property management companies or resident associations handle these tasks, and their fees are included in the service charges, making them higher for flats in large blocks.

Large blocks set aside funds for major repairs or renovations. These funds are collected through service charges over time. Flats in big blocks may have higher charges to build and maintain these funds.

Flats in large blocks often share things like heating, water, or waste management services. The costs for these shared services are divided between the flat owners, which can contribute to higher service charges.

Large blocks may hire professional property management companies. These companies handle various tasks and charge fees, which can increase the service charges.

To determine if a service charge is too much, compare it to the average. In England, the average annual service charge for properties up to £600k is around £2,216. Consider this benchmark alongside factors like amenities, property size, property type, service charge history, and seek professional advice if needed.

Remember, what's considered "too much" depends on various factors specific to your property and location.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.